Paving the Road to Growth

Facts and figures

EUROS IN REVENUE

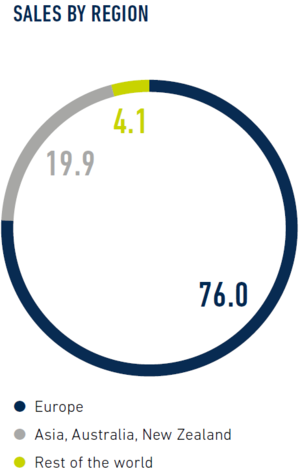

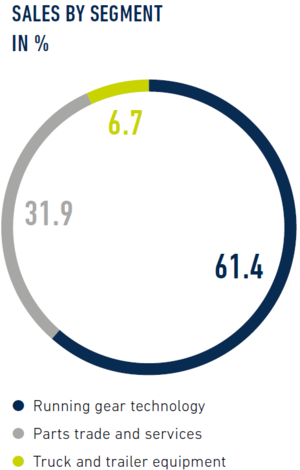

The amount generated by the consolidated companies of the BPW Group in the 2018 financial year. The total represents a year-on-year increase of 2.4 percent.

HEAVY AXLES FOR LOADS OF MORE THAN 5.5 TONS

The number of units sold by the BPW Group in the 2018 financial year. BPW is the world’s largest European manufacturer of trailer running gear – and at the same time Europe’s largest manufacturer of disc and drum brakes for trailers.

EMPLOYEES

The number of people employed by BPW Group in more than 50 countries across the world – from the Silk Road to the Kalahari Desert. Measured against the 2017 total, the labour force has grown by 2.3 per cent. The increase reflects sustained success in a stimulating market environment, strategic acquisitions in the aftermarket parts sector, and systematic investment in innovative business segments.

Market trends

IN 2018, THE BPW GROUP CONTINUED TO PERFORM WELL IN AN INCREASINGLY CHALLENGING MARKET ENVIRONMENT

Buoyed by the favourable economic climate in both Germany and the eurozone, BPW once again reported an increase in both sales volume and revenue. BPW achieved significant growth in Germany and Turkey and participated in the growth of the market together with our customers. On the other hand, embargoes, sanctions and a volatile oil price, especially in the Middle East, led to a continued reluctance to invest in new equipment. Due to the tensions in world trade and the political environment, and antitrust violations in the automotive industry, the forthcoming withdrawal of the UK from the European Union and a certain level of market saturation, BPW expects trailer production in Europe, including the CIS/TR, to decline noticeably in 2019. Furthermore, we also expect the Asian market to cool down significantly due to the trade war between China and the USA. As a result, we expect the BPW Group to post a decline in revenue overall for the year.

| 31.12.2018 | 31.12.2017 | |

| EUR | EUR | |

| A. Fixed assets | ||

| I. Intangible assets | ||

| 1. Industrial property rights and similar rights and assets as well as licences in such rights and assets | 10,317,198 | 9,542,911 |

| 2. Goodwill | 10,603,374 | 14,342,268 |

| 3. Advance payments | 157,693 | 1,546,950 |

| 21,078,265 | 25,432,129 | |

| II. Tangible assets | ||

| 1. Land and buildings | 170,474,092 | 173,806,174 |

| 2. Technical equipment and machinery | 136,253,289 | 119,144,146 |

| 3. Other equipment, operating and office furnishings | 37,672,853 | 37,001,012 |

| 4. Advance payments and assets under construction | 21,170,672 | 19,992,601 |

| 365,570,906 | 349,943,933 | |

| III. Financial assets | ||

| 1. Shares in affiliated companies | 2,035,951 | 2,051,143 |

| 2. Loans to affiliated companies | 2,849,556 | 1,349,036 |

| 3. Shareholdings | 1,388,083 | 965,305 |

| 4. Long-term investments | 2,746,063 | 2,729,225 |

| 5. Other loans | 1,381,940 | 2,213,532 |

| 10,401,593 | 9,308,241 | |

| 397,050,764 | 384,684,303 | |

| B. Current assets | ||

| I. Inventories | ||

| 1. Raw materials and consumables | 88,351,312 | 82,421,285 |

| 2. Unfinished goods | 82,724,007 | 76,547,228 |

| 3. Finished goods and merchandise | 184,249,265 | 172,616,272 |

| 355,324,584 | 331,584,785 | |

| II. Receivables and other assets | ||

| 1. Accounts receivable trade | 257,973,294 | 270,002,779 |

| 2. Receivables from affiliated companies | 727,435 | 766,629 |

| 3. Receivables from companies in which participating interests are held | 118,347 | 0 |

| 4. Other assets | 38,279,700 | 32,701,288 |

| 297,098,776 | 303,470,696 | |

| III. Securities (other) | 3,013,194 | 19,375,665 |

| IV. Cash in hand and cash in banks | 112,812,381 | 87,119,911 |

| 768,248,935 | 741,551,057 | |

| C. Accruals and deferred items | 4,479,451 | 4,942,453 |

| D. Deferred tax assets | 15,612,875 | 15,802,784 |

| 1,185,392,025 | 1,146,980,597 | |

| 31.12.2018 | 31.12.2017 | |

| EUR | EUR | |

| A. Equity | 594,344,387 | 611,865,932 |

| B. Provisions | ||

| 1. Provisions for pensions and similar obligations | 47,024,850 | 44,025,791 |

| 2. Tax provisions | 2,393,932 | 2,872,695 |

| 3. Other provisions | 62,872,257 | 58,371,844 |

| 112,291,039 | 105,270,330 | |

| C. Liabilities | ||

| 1. Liabilities to banks | 72,668,589 | 72,402,960 |

| 2. Advance payments received on orders | 11,600,936 | 8,317,553 |

| 3. Accounts payable trade | 100,132,012 | 101,927,114 |

| 4. Liabilities to affiliated companies | 93,921 | 101,113 |

| 5. Other liabilities (thereof from taxes EUR 8,742,539; previous year: EUR 10,499,329) (thereof relating to social security EUR 3,591,030; previous year: EUR 3,857,133) | 288.926.548 | 241.724.115 |

| 473,422,006 | 424,472,855 | |

| D. Accruals and deferred items | 5,334,593 | 5,371,480 |

| 1,185,392,025 | 1,146,980,597 |

NOTES TO THE CONSOLIDATED BALANCE SHEET

as of 31 December 2018

| 1. Sales revenue | 1,522,217,228 | 1,486,611,013 |

| 2. Wages, salaries, social levies and expenses for pensions and social benefits | 311,751,752 | 298,799,652 |

| 3. Valuation and depreciation methods | 7,362 | 7,196 |

Wiehl, August 2019, the Board of Management

Independent auditor’s report

THE FINANCIAL INFORMATION PRESENTED ABOVE IS AN EXTRACT FROM OUR AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR FROM 1 JANUARY TO 31 DECEMBER 2018. ON 15 AUGUST 2019, WE ISSUED THE FOLLOWING AUDITOR’S REPORT ON THE COMPLETE CONSOLIDATED FINANCIAL STATEMENTS AND THE GROUP MANAGEMENT REPORT:

INDEPENDENT AUDITOR’S REPORT

To BPW Bergische Achsen Kommanditgesellschaft, Wiehl

AUDIT OPINIONS

We have audited the consolidated financial statements of BPW Bergische Achsen Kommanditgesellschaft, Wiehl, and its subsidiaries (the Group) – comprising the consolidated balance sheet as of 31 December 2018 and the consolidated income statement for the financial year from 1 January 2018 to 31 December 2018 as well as the notes to the consolidated financial statements, including a description of the accounting and valuation methods. In addition, we also audited the group management report of BPW Bergische Achsen Kommanditgesellschaft, Wiehl, for the financial year from 1 January 2018 to 31 December 2018.

IN OUR OPINION, BASED ON THE FINDINGS OF OUR AUDIT:

- The enclosed consolidated financial statements comply in all material respects with the requirements of German commercial law pursuant to section 13 of the Public Disclosure Act (PublG) and give a true and fair view of the net assets and financial position of the Group as at 31 December 2018 and of its results of operations for the financial year from 1 January 2018 to 31 December 2018 in accordance with German generally accepted accounting principles.

- The enclosed group management report conveys an accurate overall view of the Group’s position. In all material respects, this group management report is consistent with the consolidated financial statements, complies with German legal requirements and suitably presents the opportunities and risks of future development.

Pursuant to section 322 (3)(1) of the German Commercial Code (HGB), we hereby affirm that our audit has not led to any reservations regarding the accuracy of the consolidated financial statements and the group management report.

BASIS FOR THE AUDIT OPINIONS

We conducted our audit of the consolidated financial statements and the group management report in accordance with section 317 of the German Commercial Code (HGB) and in compliance with the German Generally Accepted Standards on Auditing for financial statements as promulgated by the Institute of Public Auditors in Germany (IDW). Our responsibility under these rules and principles is further described in the section “Responsibility of the auditor for the audit of the consolidated financial statements and the group management report” of our auditor’s report. We are independent of the Group companies in accordance with German commercial law and professional regulations and have fulfilled our other German professional obligations in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions concerning the consolidated financial statements and the group management report.

LEGAL REPRESENTATIVES’ RESPONSIBILITY FOR THE CONSOLIDATED FINANCIAL STATEMENTS AND THE GROUP MANAGEMENT REPORT

The legal representatives are responsible for the preparation and fair presentation of the consolidated financial statements in accordance with German commercial law in all material respects as required by section 13 of the Public Disclosure Act (PublG) and for ensuring that the consolidated financial statements give a true and fair view of the net assets, financial position and results of operations of the Group in accordance with German generally accepted accounting principles. In addition, the legal representatives are responsible for the internal controls that they have determined to be necessary in accordance

with German generally accepted accounting principles to ensure that the consolidated financial statements are free from material misstatements, whether intentional or unintentional.

When preparing the consolidated financial statements, the legal representatives are responsible for assessing the Group’s ability to continue as a going concern. Furthermore, they have the responsibility to disclose matters that relate to the company’s ability to continue as a going concern, if any such matters exist. In addition, they are responsible for preparing the financial statements in accordance with the going concern principle, except where otherwise required by actual or legal circumstances.

Moreover, the legal representatives are responsible for preparing the group management report, which as a whole provides a suitable view of the Group’s position and is consistent with the consolidated financial statements in all material respects, complies with German legal requirements and suitably presents the opportunities and risks of future development. Furthermore, the legal representatives are responsible for the precautions and measures (systems) that they have deemed necessary to ensure that the group management report can be prepared in accordance with the applicable German legal provisions and that sufficient suitable evidence can be provided for the statements in the group management report.

RESPONSIBILITY OF THE AUDITOR FOR THE AUDIT OF THE CONSOLIDATED FINANCIAL STATEMENTS AND THE GROUP MANAGEMENT REPORT

Our objective is to obtain reasonable assurance as to whether the consolidated financial statements as a whole are free from material misstatements, whether intentional or unintentional, and whether the group management report as a whole provides a suitable view of the Group’s position and is consistent, in all material respects, with the consolidated financial statements and the findings of our audit, complies with German legal requirements and suitably presents the opportunities and risks of future development, and to issue an auditor’s report that includes our audit opinions on the consolidated financial statements and the group management report.

Sufficient assurance is a high level of assurance, but not a guarantee that an audit conducted in accordance with section 317 of the German Commercial Code (HGB) and in compliance with the German Generally Accepted Standards on Auditing for financial statements as promulgated by the Institute of Public Auditors in Germany (IDW) will always reveal a material misstatement. Misstatements could result from wrongdoing or inaccuracies and are considered material if it could reasonably be expected that they would individually or collectively impact financial decisions made on the basis of these consolidated financial statements and group management report.

DURING THE AUDIT, WE EXERCISE OUR BEST JUDGMENT AND MAINTAIN A CRITICAL ATTITUDE. IN ADDITION:

- We identify and evaluate the risks of material misstatements, whether intentional or unintentional, in the consolidated financial statements and group management report, plan and perform audit procedures in response to those risks and obtain audit evidence sufficient and appropriate to provide a basis for our audit opinions. The risk that material misstatements will not be detected is greater in the case of wrongdoing than in the case of inaccuracy, as wrongdoing may involve fraudulent collusion, falsification, intentional incompleteness, misrepresentation or suspension of internal controls.

- We gain an understanding of the internal control system relevant to the audit of the consolidated financial statements and of the procedures and measures relevant to the audit of the group management report in order to plan audit procedures that are appropriate under the circumstances, but not for the purpose of expressing an opinion on the effectiveness of these systems in use by the company.

- We evaluate whether the accounting policies adopted by management are appropriate and whether the estimates and related disclosures made by management are reasonable.

- We draw conclusions about whether the legal representatives’ application of the going concern principle is appropriate and, on the basis of the audit evidence obtained, whether any material uncertainty exists in relation to events or circumstances that could cast significant doubt on the group’s ability to continue as a going concern. If we conclude that any material uncertainty exists, we are required to express an opinion on the consolidated financial statements and on the group management report based thereon or, if the information is inappropriate, to modify our opinion thereon. We draw our conclusions on the basis of the audit evidence obtained up to the date of our audit opinion. Future events or circumstances may, however, result in the group no longer being able to continue as a going concern.

- We express an opinion on the overall presentation, the structure and the content of the consolidated financial statements, including the notes, as well as on whether the consolidated financial statements present the underlying transactions and events in such a way that they give a true and fair view of the net assets, financial position and results of operations of the Group in accordance with the generally accepted accounting principles in Germany.

- We obtain sufficient suitable audit evidence for the accounting information of the companies or business activities within the Group to express an opinion on the consolidated financial statements and the group management report. We are responsible for directing, monitoring and performing the audit of the consolidated financial statements. We bear sole responsibility for our audit opinions.

- We assess the consistency of the group management report with the consolidated financial statements, its compliance with applicable law and its presentation of the Group’s position as a whole.

- We perform audit procedures on the forward-looking statements in the group management report as presented by the legal representatives. On the basis of sufficient and suitable audit evidence, we, in particular, verify the significant assumptions on which the forward-looking statements by the legal representatives are based and assess the proper determination of the forward-looking statements based on these assumptions. We do not express an independent opinion on the forward-looking statements or the underlying assumptions. There is always a significant and unavoidable risk that future events will differ substantially from the forward-looking statements.

Among other things, we discuss the planned scope and schedule of the audit and significant findings of the audit, including any deficiencies in the internal control system identified during our audit, with those responsible for monitoring the audit.

Cologne, 15 August 2019

SJS Schwieren Jansen Scherer GmbH

Auditors/tax consultants